Finix is a payments startup that provides tech-enabled businesses with embedded payment processing services via APIs. Before a business can access a sandbox account to test the API integrations, they must first contact Sales and go through the entire sales process. Once approved, Support would then manually create a sandbox account for the business.

Problems

- User: Prospects don't want to waste time talking to Sales becaused their technical teams want to test things right away.

- Business: Sales was spending too much time on smaller growth accounts which took time away from going after the bigger accounts.

Solution

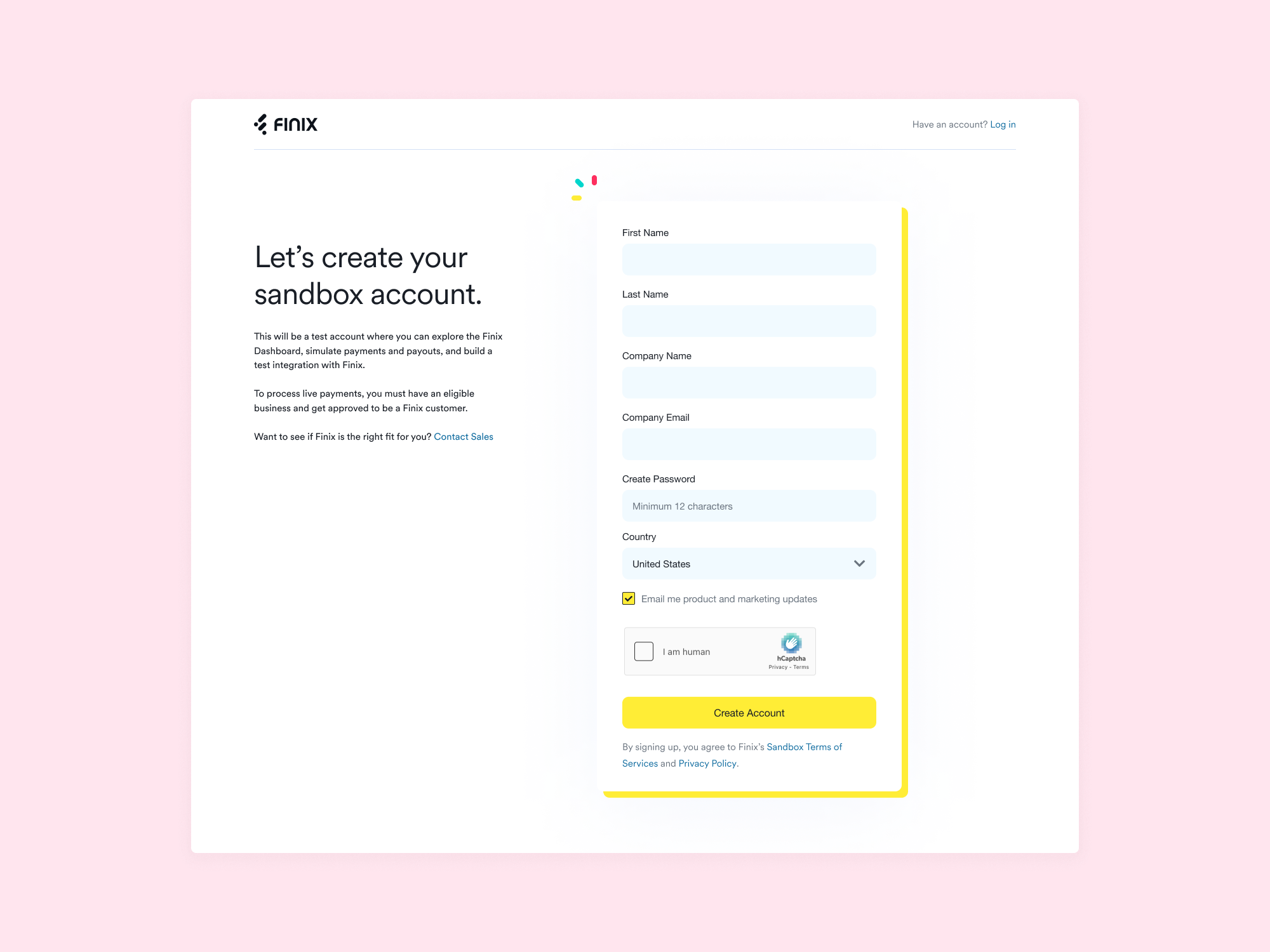

- Phase 1: Provide the ability for prospects to sign up for a sandbox account.

- Phase 2: Provide the ability for prospects to apply for a live account to process payments.

⭐ Self-Service Sign-UpPhase 1

A signup form itself is simple. However, the challenging part was how open-ended and poorly-defined this project was and how it would require working with multiple stakeholders and siloed teams to figure it out.

This was the first and largest cross-functional project and I led the product and design efforts along with cross-functional coordination among teams.

Cross-functional Collaborators

Product, Engineering, Technical Writing, Support, Customer Success, Marketing, Sales, Legal, BizOps

Goals

- User: Allow prospects to sign up for a sandbox account by themselves without having to talk to Sales first.

- Business: Focus on bigger deals and capture quality website/signup leads.

Highlighted Contributions

- Interviewed multiple teams to map out the customer journey from the marketing website to the sandbox account and defined the final scope and requirements for Phase 1.

- Worked with Marketing to align on signup fields, add signup button to the website, capture leads from signup form, and re-route signups to SDRs if the processing volume exceeded a certain threshold.

- Worked with BE to build a new API to capture sign up form data and route to Salesforce, with Product to create an in-app tutorial to help with onboarding, and with Technical Writing to add signup button to dev docs.

Impact

- Immediate signups right away that validated the need to also allow prospects to apply for a live account.

- SDRs were notified when accounts with higher gross processing volume came through and they were able to send better quality leads to AEs.

- Cross-functional teams aren't working in silos and understood the signup flow and how it impacted their teams.

⭐ Live Account ApplicationPhase 2

Cross-functional Collaborators

Product, Engineering, Technical Writing, Support, Customer Success, Marketing, Sales, Legal, BizOps, Payments Operations (including Underwriting, Compliance)

Goals

- User: Allow prospects to apply for a live account from the sandbox account and once approved, provide help center to help with successful onboarding.

- Business: Create an aplication form to collect data and automate underwriting, and extend signup and application experience to new customer segments.

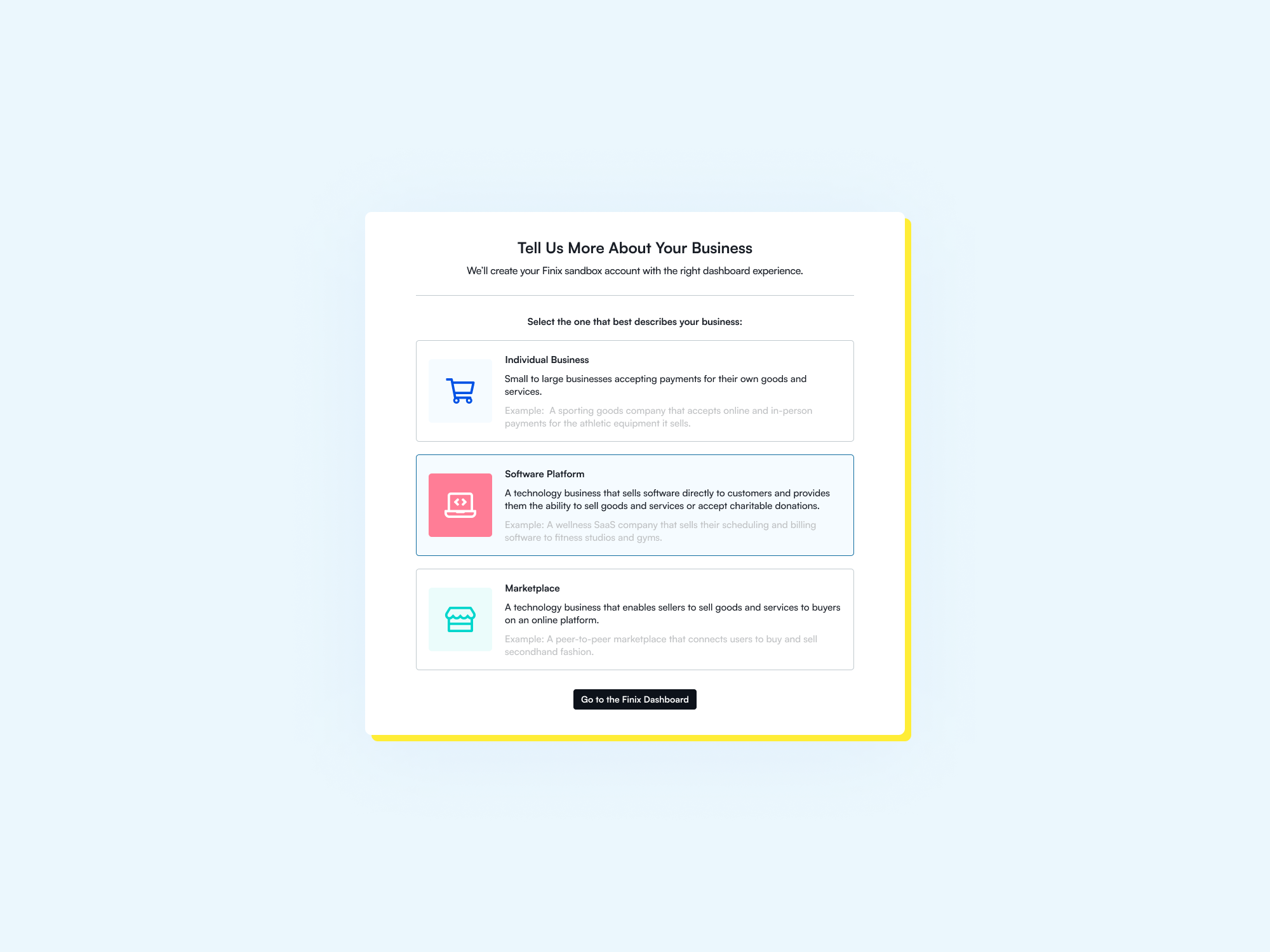

Updating the signup flow

Before

- Signup flow only supported SaaS companies - the only ICP the business focused on.

- Sandbox experience was for the sole ICP.

After

- Added two new ICPs: individual merchant businesses and marketplaces.

- Collaborated cross-functionally to define each sandbox experience for the three ICPs and translated that into requirements for Engineering.

- Updated the signup flow to support all ICPs and worked with Technical Writing to update dev docs to reflect new ICPs.

Impact

- Gained insight into the types of businesses that were interested in Finix’s services.

- Validated the need to build out the Sales team to focus on individual merchant businesses since these made up the majority of signups.

Adding an application flow

Before

- A Google form was used to collect a prospect's business information for underwriting approval.

- No form validation = faulty data + requires multiple rounds of back-and-forth and revisions to underwrite a prospect.

- Data lived in a spreadsheet and looking up information was time-consuming and inefficient.

After

- Created an in-app application form that securely stored the data.

- Added tooltips to provide helpful information and defined the validation for every field to improve data quality.

- Worked with the Payments Operations team to reduce form and only include fields required by compliance policies.

- Worked with cross-functional partners to ensure transparency around information collected and required, pricing, and contracts.

Impact

- Provided a secure way to collect and store data, and set up the path to automate underwriting.

- Carried field validation work to merchant onboarding forms and increased the data quality there too.

- Shortened the underwriting process because the back-and-forth for addtional information and revisions was minimized.

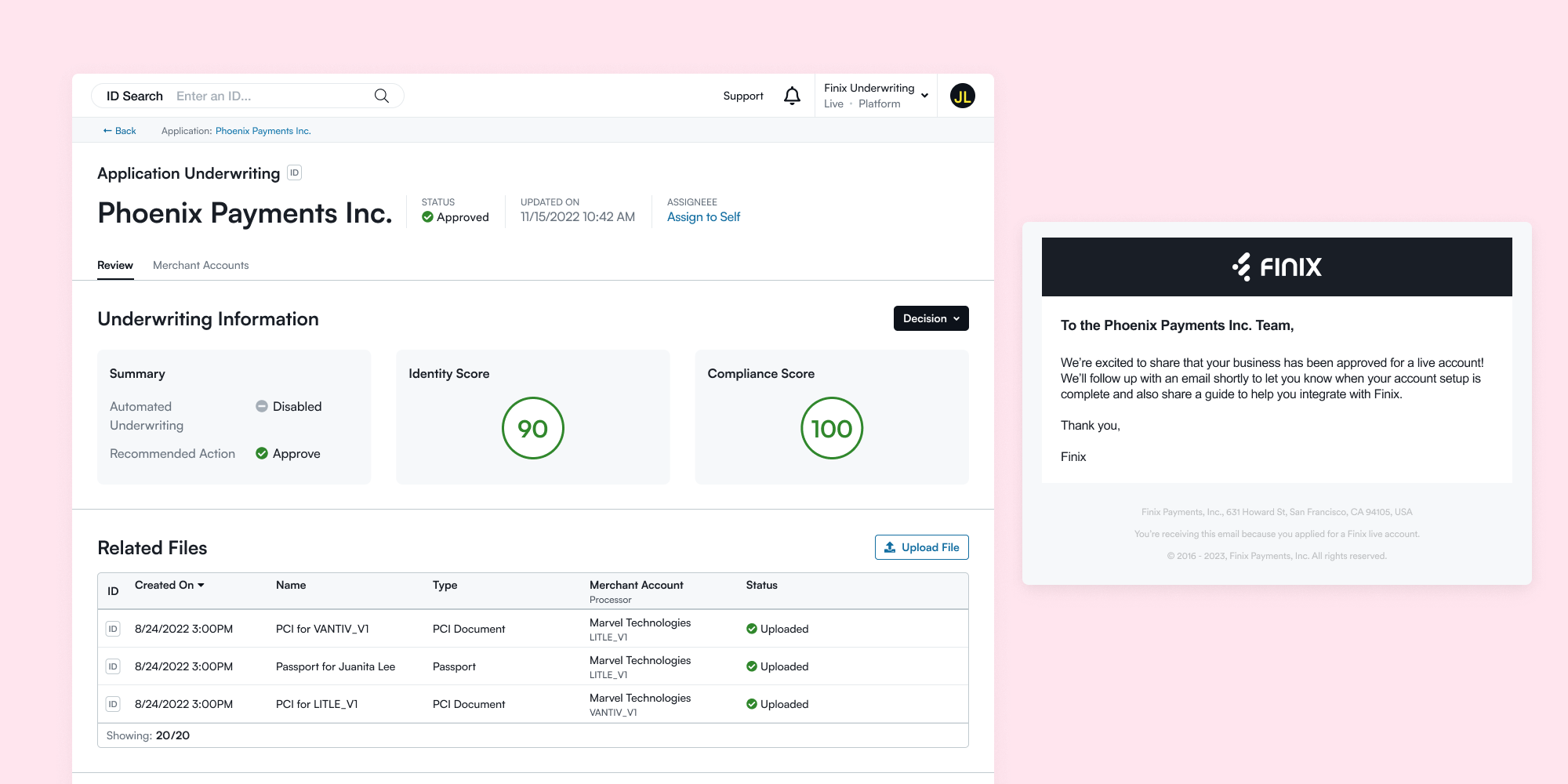

Automating the underwriting flow

Before

Underwriting was 100% manual and required underwriters to copy data from a spreadsheet and paste into 3rd party platforms to complete KYB and KYC checks. All records were kept in Google Drive.

After

Automated underwriting at the customer-level, digitized the application process, and stored underwriting data on the internal underwriting dashboard. Also automated emails to notifiy customers of their application progress.

Impact

- Cut underwriting processing time from days to hours.

- Set up the infrastructure and experience to be able to underwrite customers outside of the self-service signup flow (e.g. large accounts handled by AEs).

⭐ Conclusion

Overall Business Impact

This project started out with two high-level goals, a hard deadline, and no actual plan. While the design work itself was straightforward, figuring everything the led up to the designs was the hard part and required collaboration from ALL teams to make the launch successful.

- Market: Extended offering to new ICPs to expand market reach.

- Underwriting: Automated and streamlined workflows to cut processing time from days to hours.

- Cross-functional Collaboration: Everyone came out of it understanding each other's functions better, and how to work together for future projects.

- Customers: Able to sign up for a sandbox account, apply for a live account, and self-onboard without requiring time and resources from employees.

Highlighted Cross-Functional Feedback

- Legal: "The Design/Legal collaboration was awesome. Juanita was a rockstar at proactively spotting potential issues that needed legal (and for that matter, other cross-functional stakeholder input) and raising those issues so we could resolve them as soon as possible."

- Engineering: "Juanita did a great job managing shifting business requirements and pushing back when necessary so requirements wouldn’t change during development. On top of that, she helped QA the FE and found issues that were fixed before the final release."

- Payment Operations: "Shoutout to Juanita for gathering our input and feedback to design an underwriting experience that makes sense."

- Technical Writing: "Exciting to see Juanita jump in and take this project to the finish line. I don’t think it would have happened without her taking the lead."

- Marketing: "We came together cross-functionally to execute on time despite constant change throughout the quarter/project. I think this is a real testament to the senior skill level across each team - a special shoutout to Juanita who led the PDE side and ensured teams were looped in."