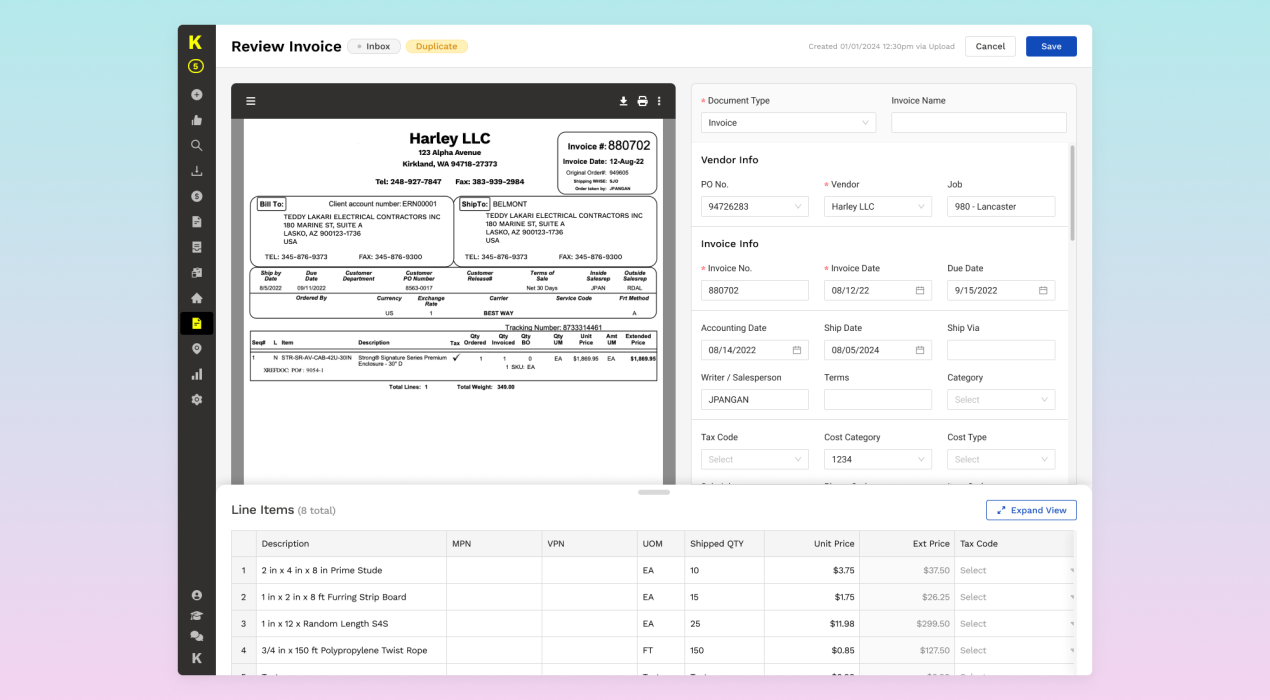

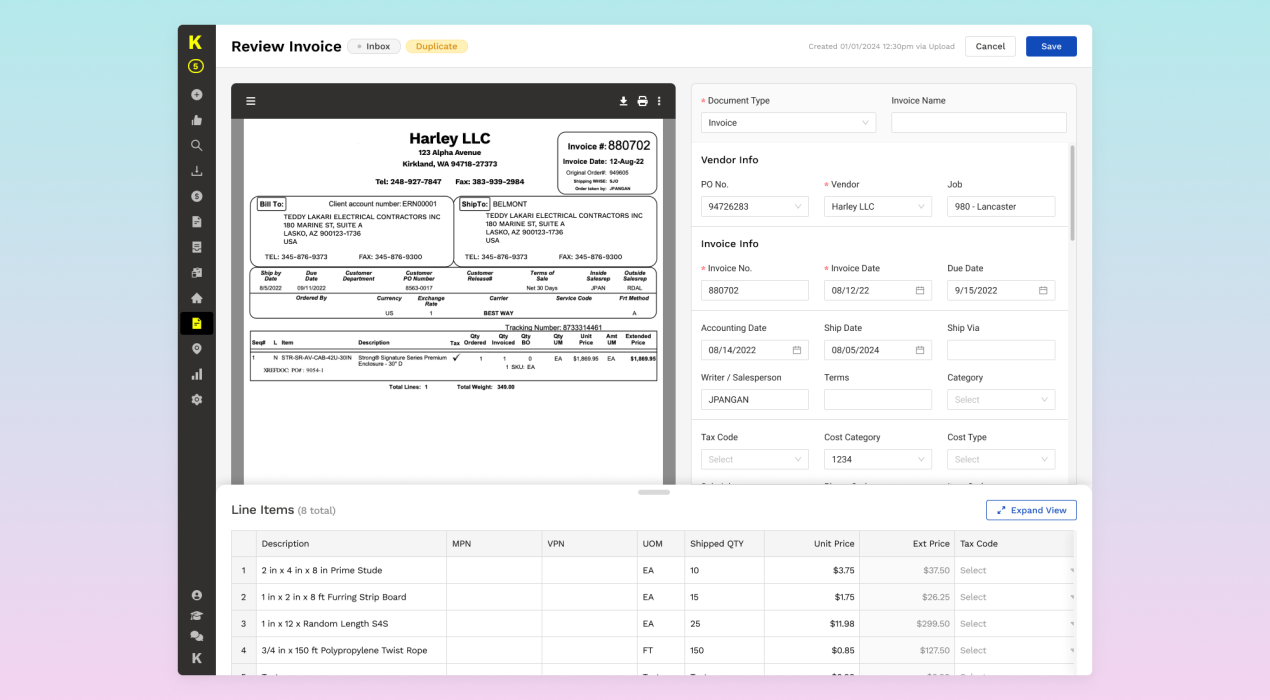

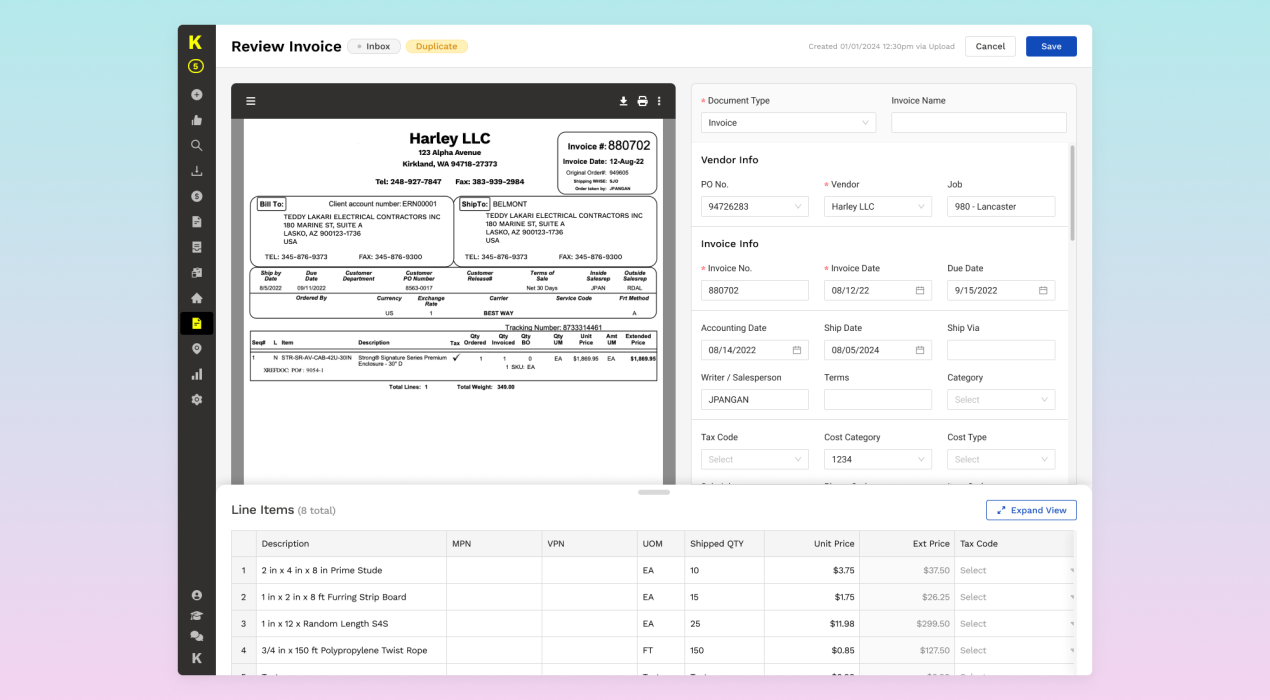

[Kojo] Accounts payable within construction tech

Kojo provides trade contractors a way to manage construction materials procurement, tools, and warehouse inventory. Within construction tech, I led design for the fintech offering Kojo AP (accounts payable) which covers the last steps of the procurement process – invoicing and payments. Kojo AP is a suite of features designed for commercial construction accounting teams and streamlines the invoice reconciliation and approvals process. ⭐ Invoice PaymentsHighlighted Work (1 of 2) Prior to joining the team, the work needed to launch payments was already in progress - an extensive payments roadmap was already defined, MVP designs were already done, and engineering work for the MVP was at the tail end. However, the team was stuck and already 1+ months behind in launching the beta. The MVP included the ability for customers to apply for underwriting approval for payments, adding bank accounts, and paying for invoices via direct debit / ACH. The payments roadmap was unrealistic and focused on adding a lot of net-new features. It didn't make senses to try and expand the payments offering if we couldn't even provide the basics so I pushed to prioritize work based on the AP user needs and workflows. Documenting the customer journey and […]

Read More ›

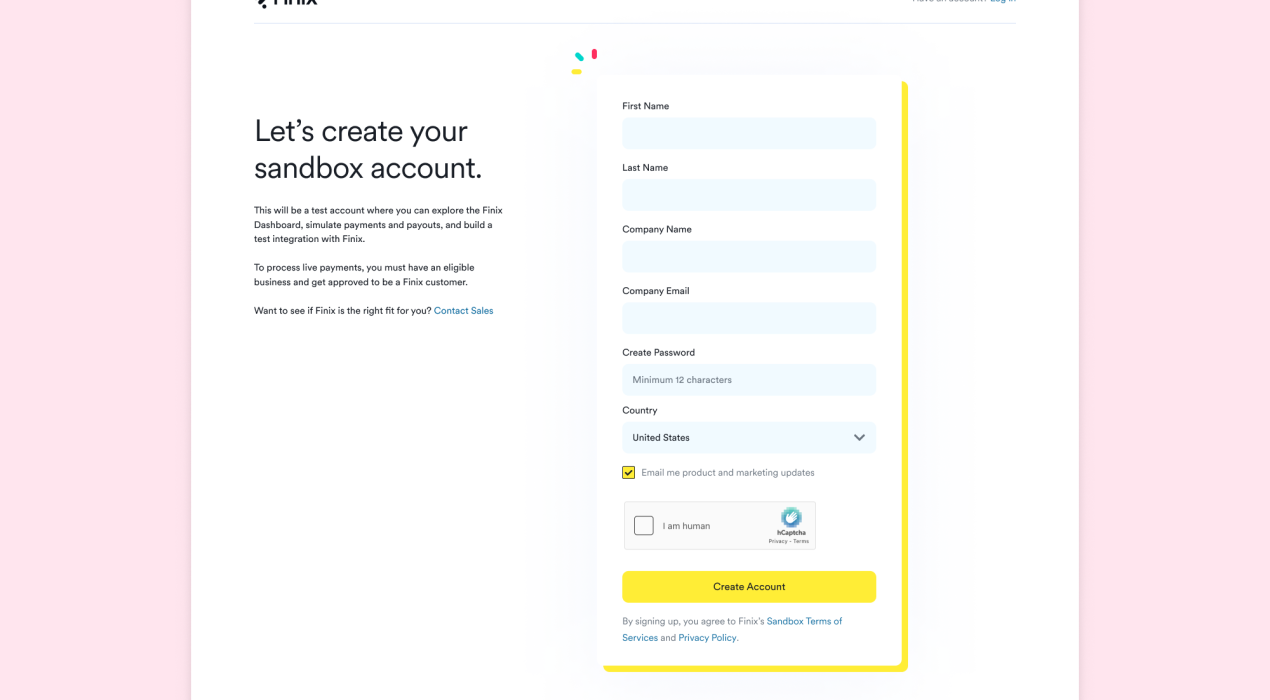

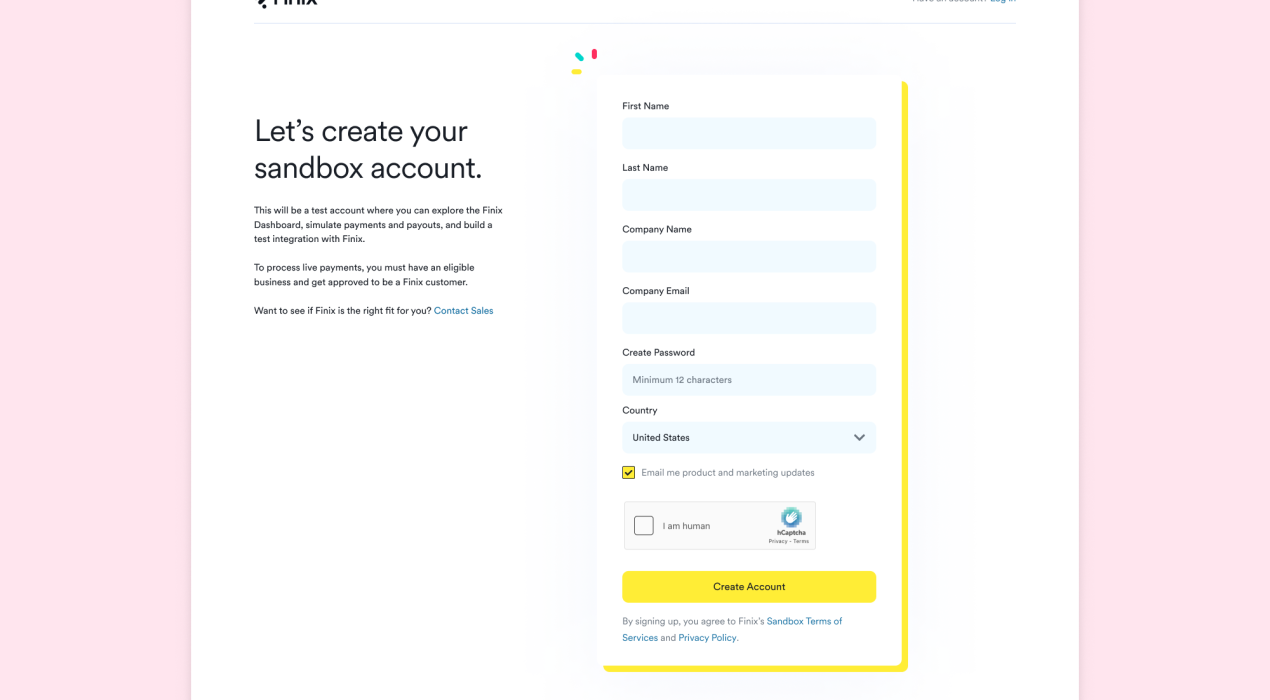

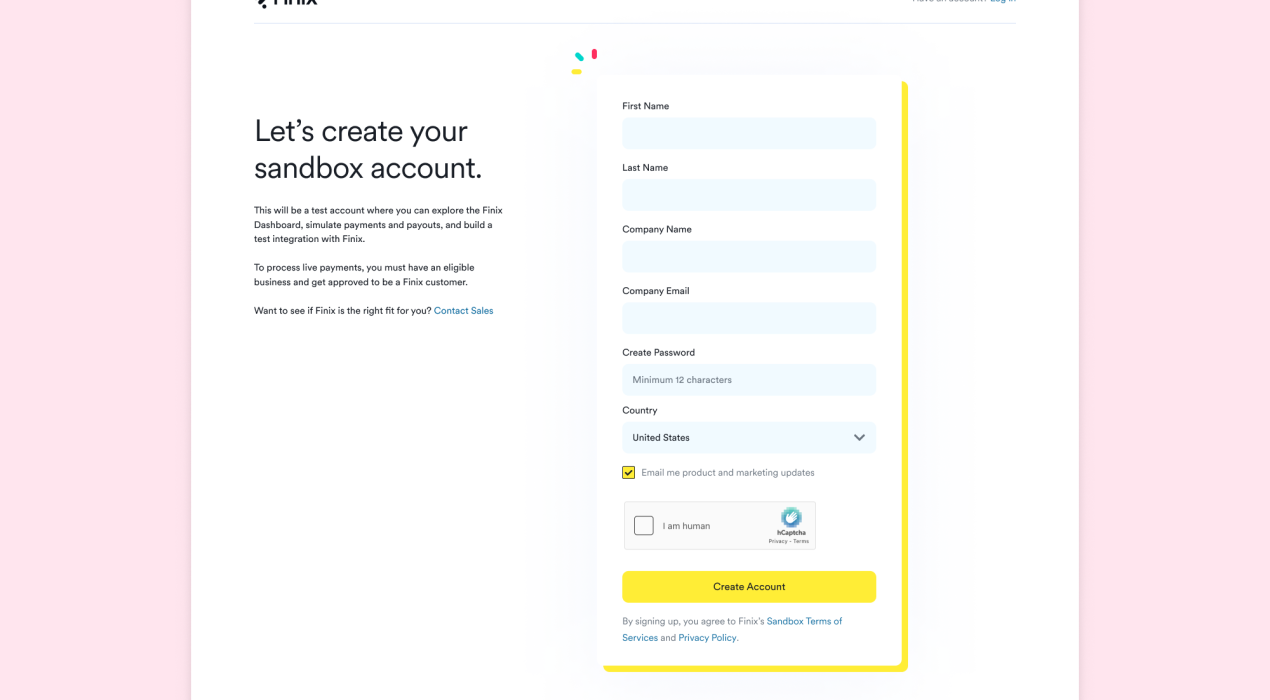

[Finix] Self-service signup and live account application

Finix is a payments startup that provides tech-enabled businesses with embedded payment processing services via APIs. Before a business can access a sandbox account to test the API integrations, they must first contact Sales and go through the entire sales process. Once approved, Support would then manually create a sandbox account for the business. Problems User: Prospects don't want to waste time talking to Sales becaused their technical teams want to test things right away. Business: Sales was spending too much time on smaller growth accounts which took time away from going after the bigger accounts. Solution Phase 1: Provide the ability for prospects to sign up for a sandbox account. Phase 2: Provide the ability for prospects to apply for a live account to process payments. ⭐ Self-Service Sign-UpPhase 1 A signup form itself is simple. However, the challenging part was how open-ended and poorly-defined this project was and how it would require working with multiple stakeholders and siloed teams to figure it out. This was the first and largest cross-functional project and I led the product and design efforts along with cross-functional coordination among teams. Cross-functional Collaborators Product, Engineering, Technical Writing, Support, Customer Success, Marketing, Sales, Legal, BizOps […]

Read More ›

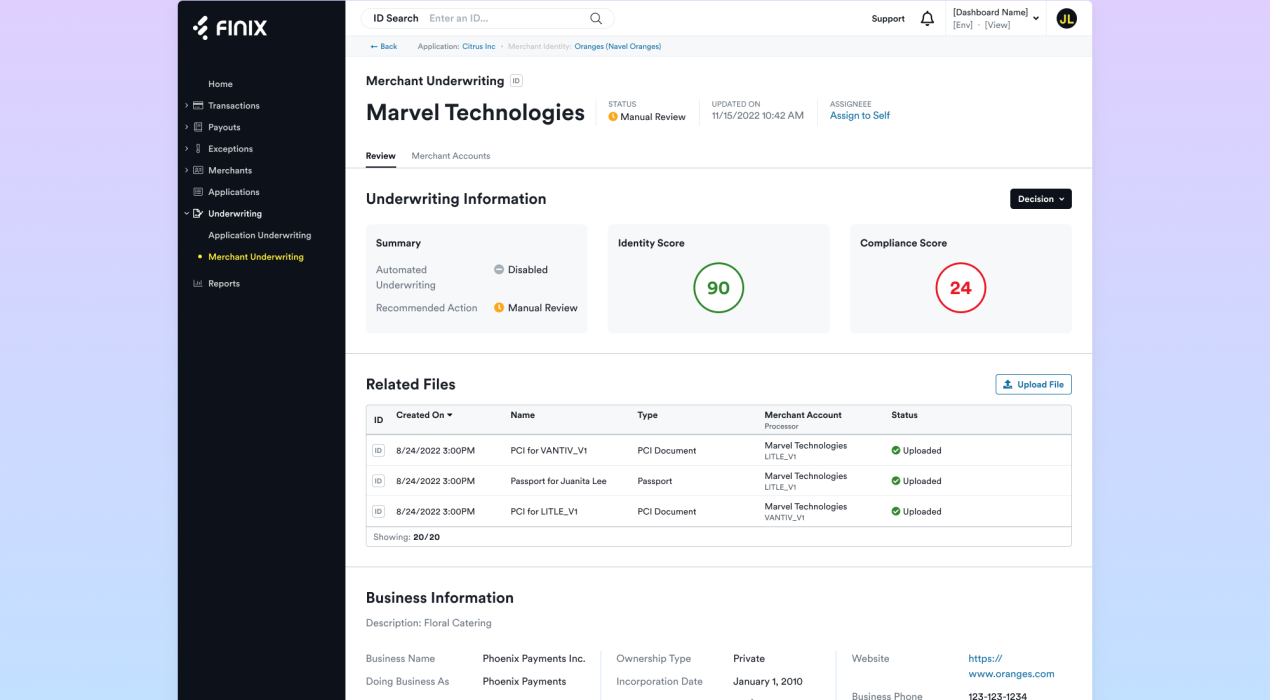

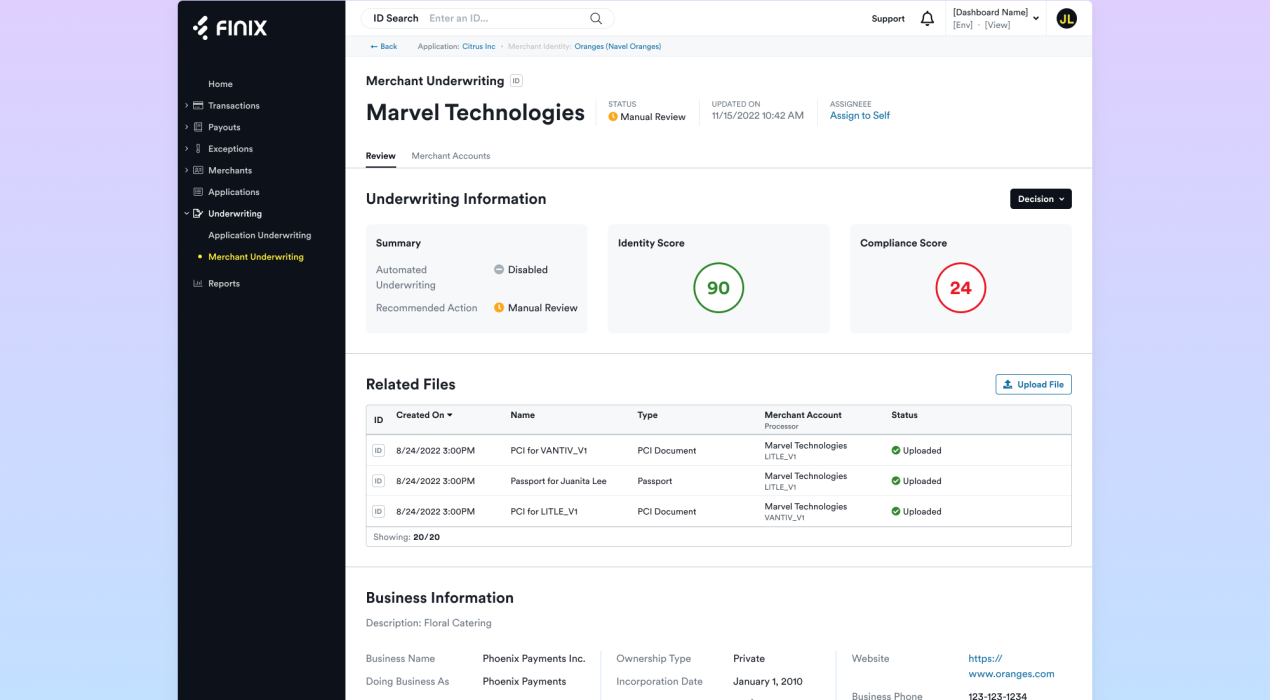

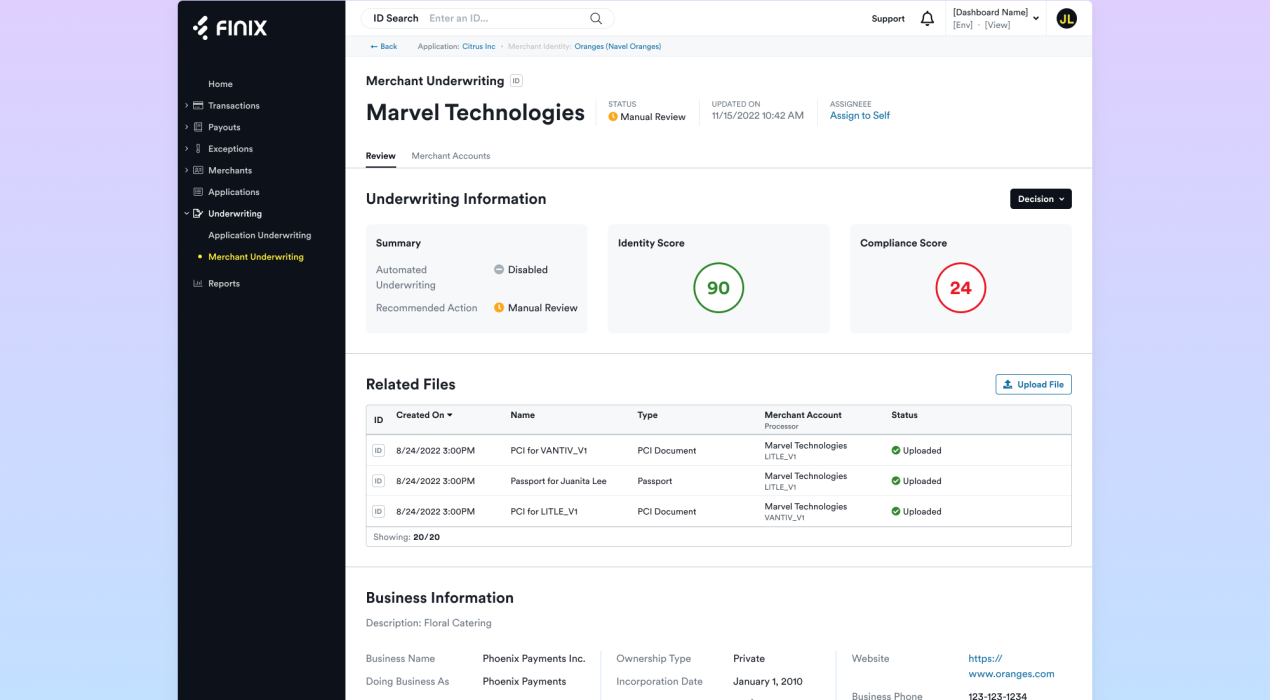

[Finix] Merchant underwriting for payments

Finix is a payments startup that provides tech-enabled businesses with embedded payment processing services via APIs. Before a business can embed payments, they must be get underwriting approval (KYB / KYC). If a business has merchants (e.g. the SaaS customers of a Finix customer), the merchants must complete onboarding forms for underwriting approval. The Finix underwriting team uses an internal interface that never evolved beyond the first iteration; onboarding form and third-party reporting data was simply dumped on a multi-tabbed page and since it was hard for underwriters to make sense of the data, the underwriting process took longer than needed. Streamlined underwriting experience Before: Submitted merchant data was spread across multiple tabs, displayed based off of the API structure, and not organized based on underwriting workflows Experience was "designed" by product/engineering (when there was no design team) without underwriting involvement and remained untouched since the first iteration Underwriters didn't trust the data because it wasn't presented in a user-friendly way and therefore relied on a lot of manual work to make decisions After: Streamlined experience after working with the underwriting team to learn about their workflows and pain points, and hear their feedback. While there were still engineering constraints […]

Read More ›

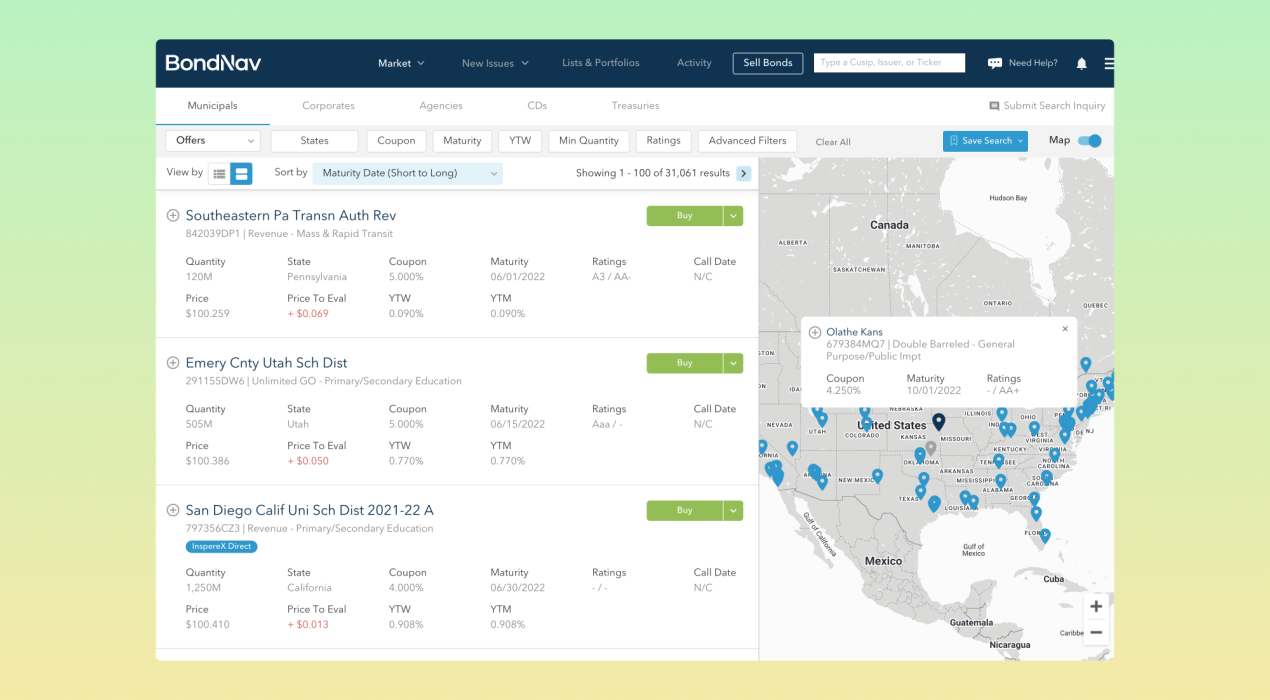

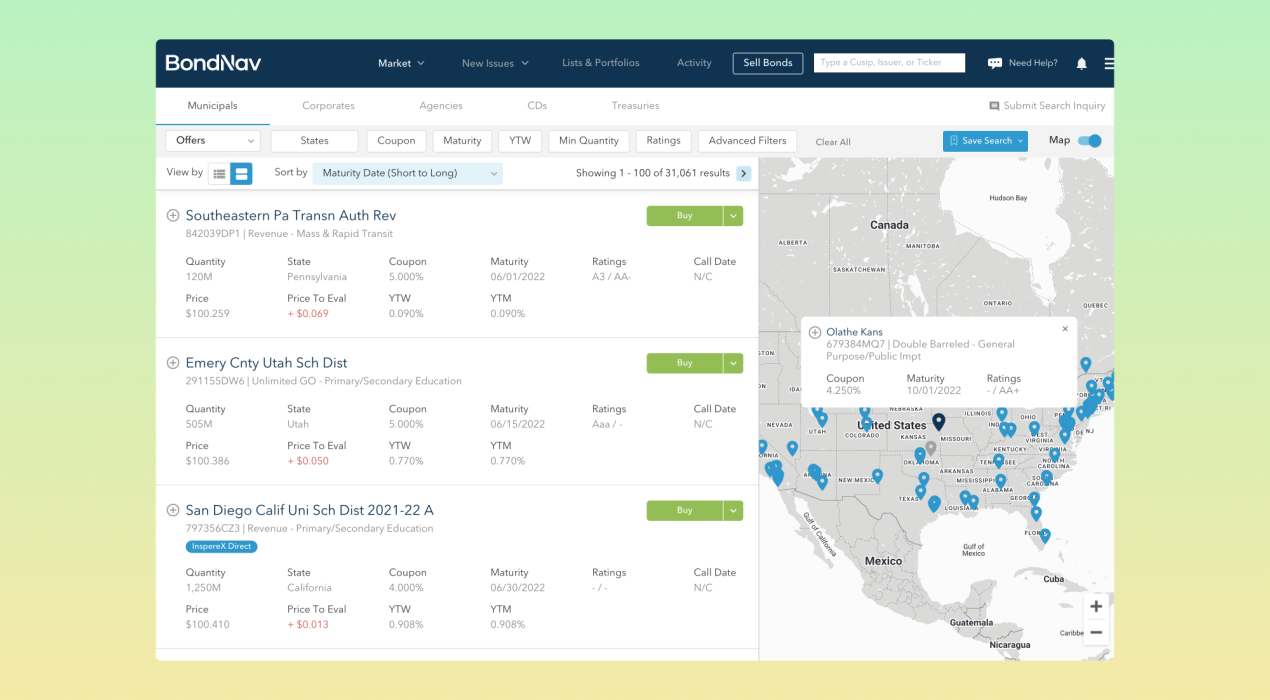

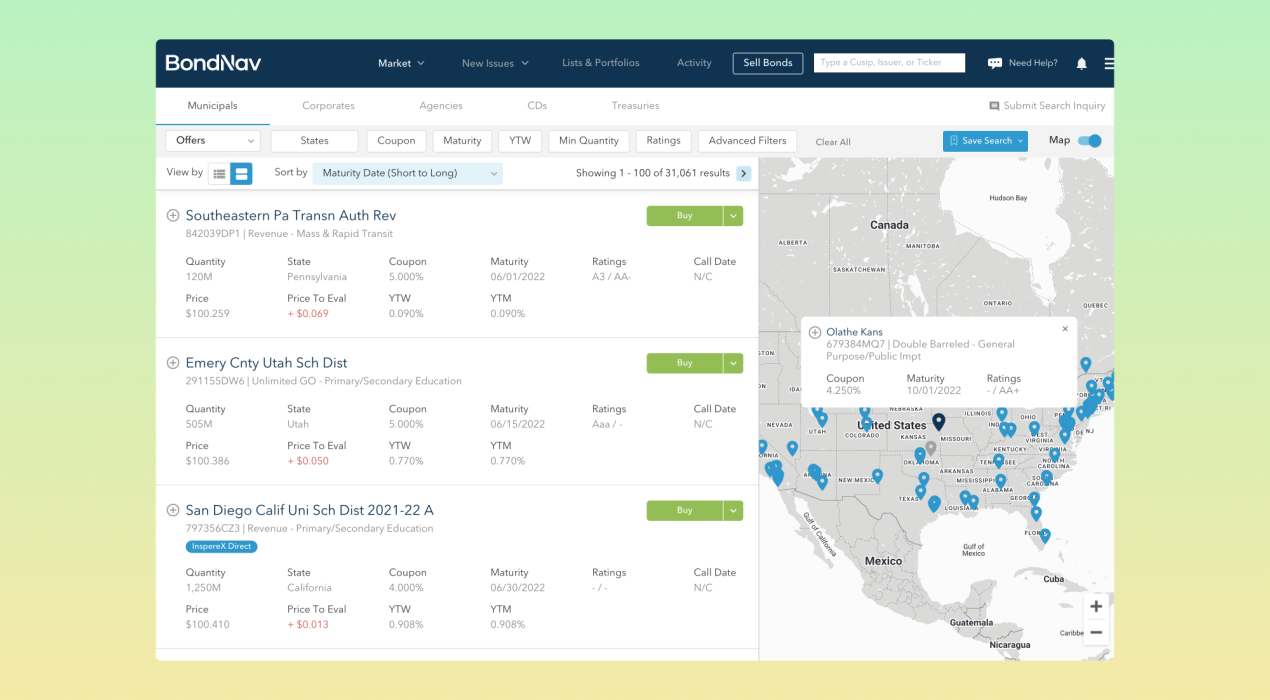

[InspereX] Multi-sided fixed income trading platform

InspereX is a fintech firm with a mission of improving fixed income distribution and trading for all market participants. InspereX is also the merging of 280 CapMarkets (an early-stage fintech startup I joined) and Incapital (a leading underwriter and distributor of fixed income and market-linked securities). As the first and sole design hire, I led product design and worked cross-functionally across four product areas (Reference Data, New Issues, Lists & Alerts, and Trade Desk) with four PMs, four engineering teams, and two web applications (multi-sided marketplace): BondNav: platform for [1] Registered Investment Advisors (RIAs) to buy, sell, and manage bonds and [2] firms to leverage as a tool for their internal trade desk to review and work orders BondNav Admin: internal tool for the internal trade desk to manage orders and other administrative tasks During my time at InspereX, I unified the overall Bondnav brand by defining a color palette and usage guidelines. I also created a design system with standardized patterns and components that were used across design and FE. While I do not get into the details or highlight the complex workflows I worked on, the following snippets will show how much BondNav has evolved. Market Redesign Highlighted […]

Read More ›